You are speculating on ?

Current price: ?

🟢 Current round

One round = ?

Round

?

?

Start time

?

?

TWAP

?

?

Winner

?

?

🐂Bullish stakes

?

?

🐻Bearish stakes

?

?

If you are on the side with less stakes, or if you stake earlier, your odds is increased. Click for formulas (current factor_stake=?, factor_time=?).

🔵 Previous rounds

Commission = ? % (only charged on profits).

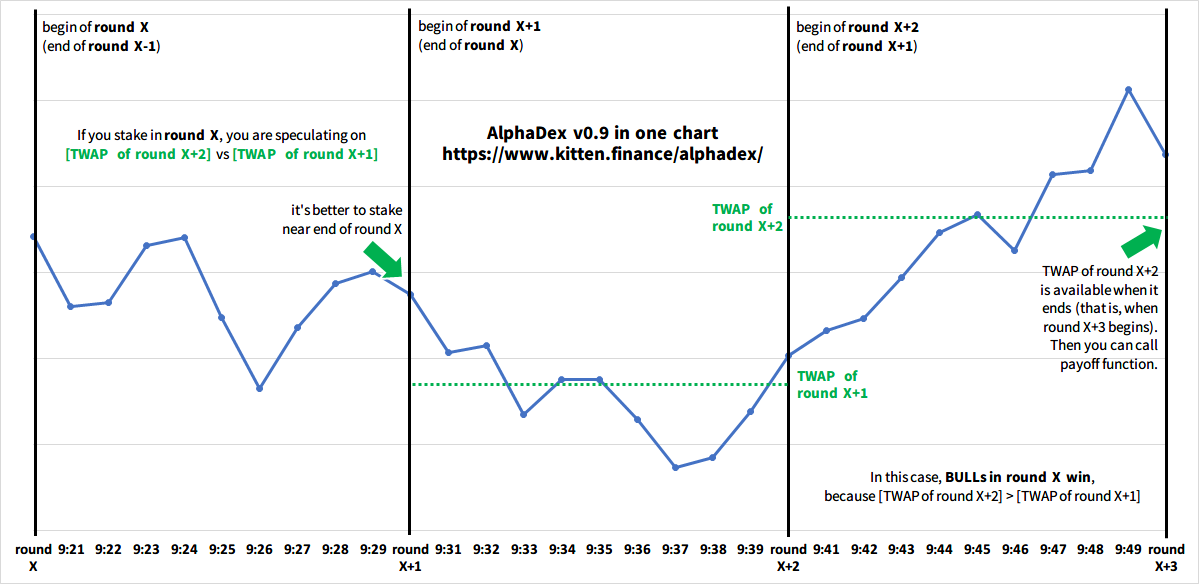

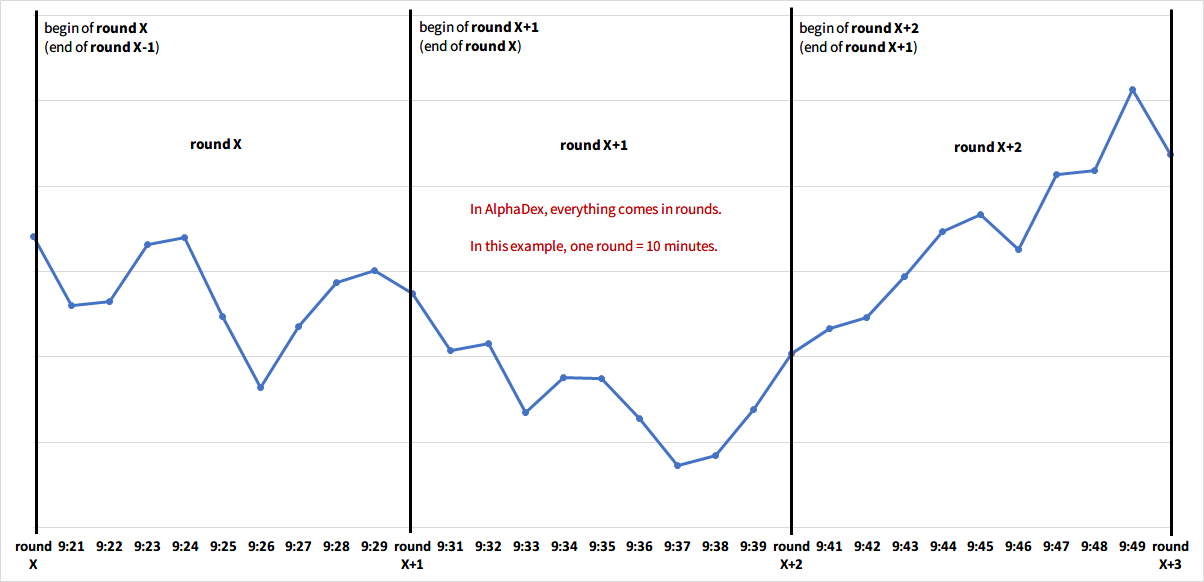

AlphaDex is a decentralized derivative market and liquidity aggregator. You are looking at its first function, similar to a binary option market settled by smart contracts.

There are always 3 rounds in a day: UTC 0:00~8:00, 8:00~16:00, 16:00~0:00. If [Sync] is not called at the desired start time, then the start time is delayed, however it won't affect the start time of next round.

For example, if [Sync] is called at UTC 1:15, then this round is UTC 1:15~8:00, and next round is still UTC 8:00~16:00.

There are always 3 rounds in a day: UTC 0:00~8:00, 8:00~16:00, 16:00~0:00. If [Sync] is not called at the desired start time, then the start time is delayed, however it won't affect the start time of next round.

For example, if [Sync] is called at UTC 1:15, then this round is UTC 1:15~8:00, and next round is still UTC 8:00~16:00.

🐂 Auto-staking vault #1 : BULLISH (stake ? % every round)

reading vault status...

receive stakes :

round X

round X

round X

reading vault status...

If some of the stakes look hopeless, you can choose to not receive them, and that can save some gases.

🐻 Auto-staking vault #2 : BEARISH (stake ? % every round)

reading vault status...

receive stakes :

round X

round X

round X

reading vault status...

If some of the stakes look hopeless, you can choose to not receive them, and that can save some gases.